Shadow grain market, cash payments, tax evasion mean that the state budget doesn’t receive tax payments, and there is no money for maintenance and development of infrastructure and social sphere of settlements on the one hand, and illegal enrichment of speculative middlemen who carry on grain trade in shadow on the other.

Unfortunately, at present it is not a rare case in Ukraine. The middlemen carry on illegal shadow business consciously, taking care only of their own enrichment. Meanwhile some agricultural producers are convinced that work for cash is profitable. However, agrarians not only become participators of illegal shadow business but also lose possibility to receive money from the state budget for development of the settlements, which are homes to them and their families. One should not forget that it is dangerous to keep cash at home – it endangers lives of your dear and near ones.

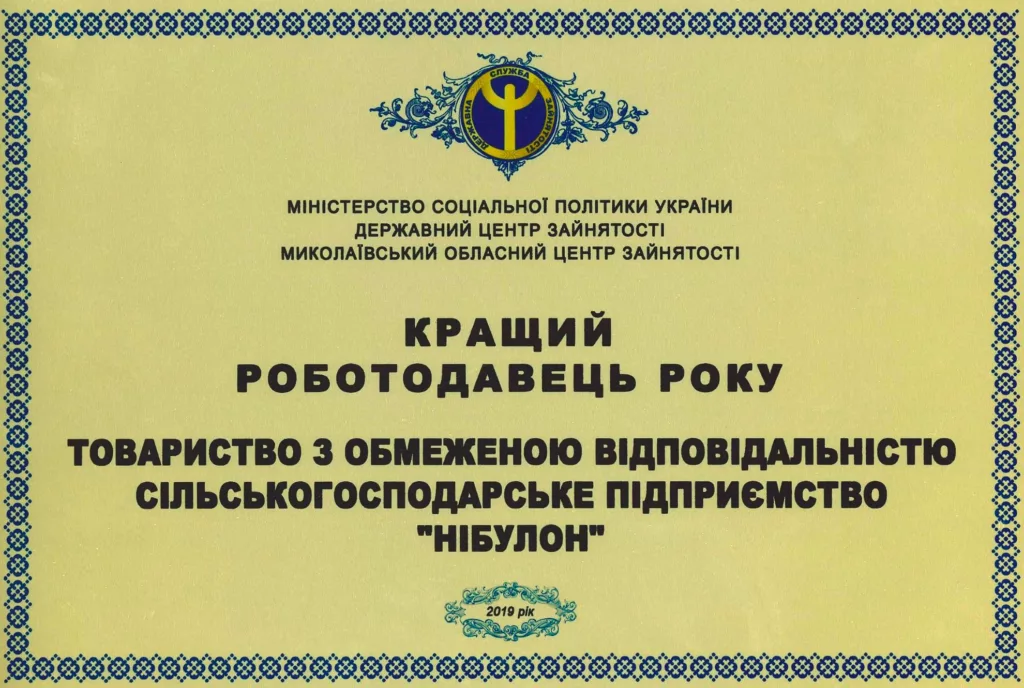

NIBULON works in grain market honestly, transparently, and openly, strictly following the Ukrainian legislation. The company has been contributing its share to legalization of grain market since it was established, and it calls on all agricultural producers to carry on business only within the legal environment, strengthening economy of the country.

NIBULON decided to start an ambitious project to involve individuals in cooperation to avoid illegal cash turnover and false documents which will cause “tax pits” in process of grain supply. This step forward can become one of the mechanisms to improve work of grain market, prevent from shadow market, and an effective way to replenish local budgets, scanty financing of which deprives the Ukrainian villages of any perspectives for development of social sphere and infrastructure.

Individual income tax can and should become a source of budget replenishment of various levels, including district budgets and budgets of territorial communities. Individual income tax is not paid because of hiding income from taxation. So, activation of all resources to fight this illegal phenomenon is in the foreground for NIBULON as for socially responsible company.

Large amounts of individual income tax should be paid, in particular, from commodities selling by individuals who are the owners of land plots. Unfortunately, we face a tendency when sums of individual income tax go to “pockets” of supporters of the shadow agrarian market who buy grain and industrial crops without any documents. They can cause loss for an individual using allegedly inappropriate grain quality.

In comparison with business entities that work transparently and pay all taxes, persons who buy grain of individuals for cash and without documents do not act as tax agents and do not pay any income tax or military tax for these transactions. So, a district budget and the State budget of Ukraine receive no money. However, the money should be directed at development of modern infrastructure of a settlement and at financing of processes to increase defence capacity of our country.

According to the Budget Code of Ukraine, district budgets and budgets of territorial communities receive 60 % from individual income tax paid by individuals to the appropriate territory.

Thus, some part of individual income tax paid by individuals should be directed at the most essential spheres of the specific region, in particular, for repair works of educational and medical institutions (kindergartens, schools, hospitals, outpatient departments, etc.), for repair and maintenance of local amenities (sports grounds, children’s playgrounds, sights of cultural and historical heritage, public gardens), street illumination, pavement repair, creation of water supply systems, sewage, objects of gas and heat supply.

Thus, selling commodities for cash and paying no taxes individuals promote harm to social sphere of a region.

According to the requirements of the Tax Code of Ukraine, income earned by an individual from agricultural products sale is not included in taxpayer’s total monthly (annual) taxable income if the area of land plots for private farming and/or land plots (shares), assigned at the site does not exceed 2 hectares. Thus, an individual who sells agricultural commodities but is not registered as an entrepreneur has chances to pay no individual income tax and not to show income in an annual tax declaration if he submits a copy of certificate confirming that total area of land plots does not exceed 2 hectares. In this case a company which buys commodities doesn’t deduct individual income tax from the income that is paid to an individual for commodities.

If the area of land plots exceeds 2 hectares, income from agricultural products sale is taxable according to the standard procedure (18%) and should be reflected in the declaration of property assets and income of an individual. 1,5 % military tax should be also deducted. Thus, all individuals who sell commodities and have land plots that exceed 2 hectares should pay taxes.

Of course, we realize that tax payment should not frighten individuals to legalize their business. An individual should not work at a loss but should receive adequate compensation for work at a land plot selling agricultural products for favourable price. So, NIBULON is ready to cooperate on mutually beneficial terms, to buy agricultural commodities produced by individuals, and to offer a beneficial way for cooperation. Let us consider everything step by step.

If we consider current prices for companies and farms which are payers of value added tax, then we will have to deduct from e.g. barley price:

1) VAT 3 890 UAH – UAH 3 890 – 3 890 / 6 = 3 241,67 (price without VAT);

2) individual income tax UAH 3 241,67 – UAH 3 241,67 *18 % = UAH 2 658,17;

3) military tax UAH 2 658,17 – UAH 3 241,67 * 1.5 % = UAH 2 609,54.

However, an individual can get cash payment of 2 700 UAH/ton. So, advantages of legal operations are in doubt. NIBULON offers another variant of calculations taking into account a real market. We can try to be competitive and offer e.g. 2 730 UAH/ton for grain of basic conditions, the sum an individual will get as net income.

In particular, according to the legislation, one must pay taxes: 18 % individual income tax and 1.5 % military tax. The total is 19.5 % . In order to define the amount of taxes for net income of UAH 2 730,00 (the price per 1 ton of grain of basic conditions) we make a simple proportion:

the sum of UAH 2730,00 is equal to 80,5% (the difference between 100% and 19,5% of taxes) of transaction out of which taxes must be paid. Thus, to receive net income of UAH 2 730,00 the gross revenue per 1 ton of grain should comprise UAH 2 730 / 0.805 = UAH 3 391,30. The difference between gross revenue and net income will comprise 19.5 % (individual income tax and military tax), in this case UAH 3 391,30 – UAH 2 730 = UAH 661,30.

Let us consider an example when an individual supplies 5 tons:

It will be included in the contract terms (in an additional agreement or in an annex).

We can summarize and single out the advantages of selling agricultural commodities by individuals within the legal environment.

The advantages for individuals:

1) buyers of grain not only pay for agricultural commodities to individuals but also pay individual income tax to the budget, which in turn will be used formaintenance of local infrastructure;

2) a company which buys agricultural commodities will show the transaction in its financial statement at the end of the quarter;

3) individuals receive certificates of charge on their income and the taxes that were paid at the end of the year (or after every quarter). It allows them to draw up declarations of property assets and income. They must not pay taxes because a buyer has already done this.

The country can enhance transparency of grain market and remove a considerable part of market from the shadow (according to specialists, 20-40 %). This in its turn will reduce possible abuses at grain export transactions and will give an opportunity to keep up prices for grain at high level.

Thus, together we can make this step forward to create favourable conditions for cooperation of individuals and grain traders, to make a significant contribution to relationships between the country and its citizens.

Neither fear of becoming accused of illegal business nor fear of being robbed by frauds or criminals should be result of your exhausting hard work. Confidence in your business, its legality, legal income, and demonstration of the fact that you have nothing to hide from the police or fiscal service will become the result of your work. Besides that, you can be sure that the taxes you have paid will be used for creation of cozy kindergartens, schools, modern medical institutions, pavement repair, road illumination, etc.

Do you still want to work for the benefit of speculative middlemen?

We appeal to supporters of shadow market – imagine the possibilities you get coming out of “shadow”. There is a chance that you will get less money but you will get legal income. You can say to anyone that you have sold grain legally. Secondly, you can say to the head of your village/town council with your head held high that you cultivate land plot, and NIBULON has paid individual income tax and military tax. The district budget will receive the money and the head of the village/town council has the right to claim deduction for development of the local infrastructure (kindergartens, schools, etc.)

If you support our army paying 1.5 % military tax you have the moral right to demand its protection.

If you sell grain illegally, the head of your village/town council will come and ask for help either for maintenance of a kindergarten or a school, or for pavement repair. So, people who know that you work “in shadow” will come with requirements to pay extra. Sum up all the expenses and it will become clear that there is an easier and more beneficial way. You can pay taxes, sell grain legally, and say with your head held high, “I have worked honestly, have paid the taxes, I can demand from you, and I do not have to pay anything more”.

Let us imagine that individuals cultivate 2 thousand hectares of land plots in a village. To simplify our calculations let us consider pessimistic yield of 2 tons of barley out of 1 ha. The total yield will comprise 4 thousand tons. According to the calculations above, the district and state budgets will receive UAH 610,43 of individual income tax per every ton of grain. The total amount of money paid for individuals will comprise UAH 2 441 736. According to the Budget Code, local budget receives 60 % of taxes – UAH 1 465 041,6.

It is a very impressive figure. For example, one needs UAH 100 thousand to equip one computer lab. So, a village council could equip 14 computer labs per one year using this sum of money. Thus, one can provide computers to all classrooms, install metal-plastic windows, spend money on repair of school per one year. If one works in such rhythm for 3-4 years, I think there will be street illumination, asphalt surfacing, repaired kindergartens, and first aid stations in villages. But still we keep on saying that we are poor, the state should take care of us, and someone should give us money. Just think, first of all, we should take care of ourselves. Using rather simple calculations I have shown that we can improve infrastructure of our villages/towns.

By the way, we omitted the fact that individuals do not work alone. So, they have to hire people, your local inhabitants, and pay legal wages. So, local budget will receive some money from wages.

The information must make local authorities, local taxpayers, individuals, farmers, and heads of village councils think. The money is real and close to you, but for some reason you do not use this money.

This is your legal income and you are free to use it legally without participation in any kind of shadow transactions. Finally, this is the first step to cooperation with any bank on loans and financing. This is your chance to run your business in a civilized and transparent way, as NIBULON has been doing for 25 years.

The information above is addressed primarily to those who work “in shadow”. At the same time, our company is grateful to the farmers who have worked or started working legally. Thank you for the fact that you carry on your business within the legal environment. Together we promote development of Ukraine’s legal grain market.

NIBULON’s General Director,

Hero of Ukraine

Oleksiy Vadaturskyy