Description of the Project (Summary Of Investments):

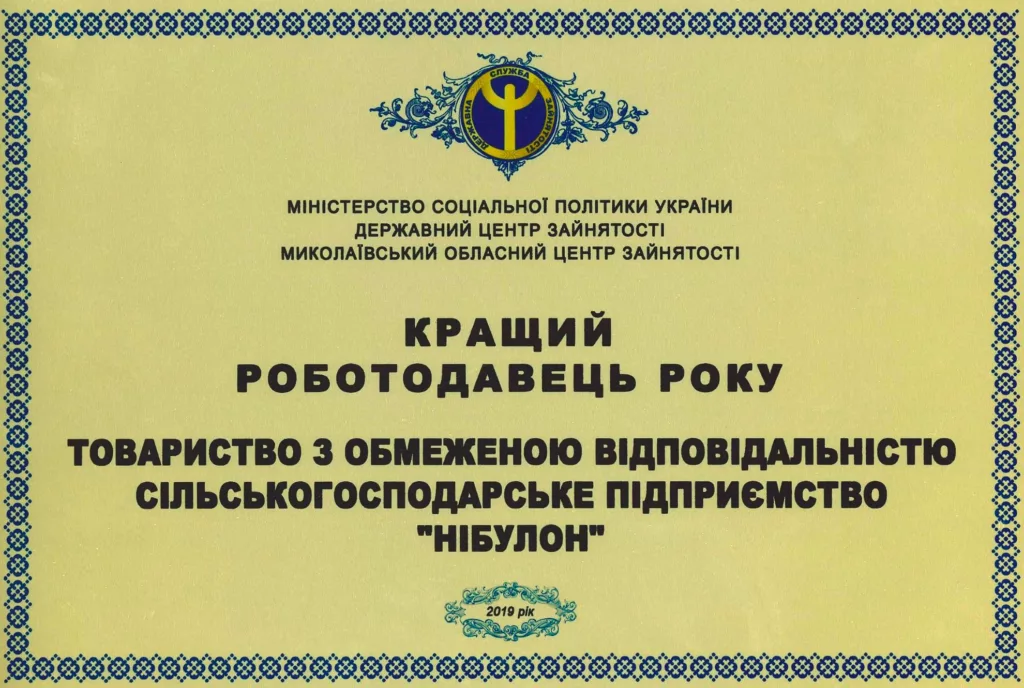

The proposed investment is to support Nibulon (“the Company”), one of the largest Ukrainian grain and oilseeds originators and exporters, by strengthening its capital base and financing the Company’s expansion. The implementation of the Company’s expansion program will increase the trading volume by approximately 40% over 5 years.

Project Sponsor and Shareholders of Project Company:

Mr. Oleksiy Vadaturskyy, the founder and the CEO of the Company, owns 80% of the shares. The remaining 20% are owned by his son, Andriy Vadaturskyy, who is currently not involved in the Company’s operations and has transferred voting rights related to his ownership share in the Company to Mr. Oleksiy Vadaturskyy.

Total Project Cost and Amount and Nature of IFC’s Investment:

The proposed IFC investment is up to US $90 million, including A and B Loans.

Project Location:

Nibulon’s key operating assets are located in Ukraine. The Company farms 82,000 hectares of land, operates second largest network of inland silos and river terminals and a modern seaport terminal, located in Mykolaiv, in the Black Sea region of Ukraine. Nibulon mainly exports corn, wheat and barley to more than 20 global destinations. Nibulon’s annual trading volume reaches 4.5 million metric tons.

Expected Development Impact of the Project:

The Project is expected to:

Enhance food security: IFC’s investment will contribute to strengthening food security by expanding the Company’s grain traded volumes from 4.5 in 2016 to 7.0 million tons by 2021 and increasing food availability by 40%.

Strengthen Ukraine’s infrastructure: Nibulon will continue supporting the development of Ukraine’s grain and oilseeds sector by creating access to storage and reducing crop losses. The Company’s ongoing investment in Ukraine’s river transport helps to revitalize the country’s commercial navigation and provides cost efficient and more environmentally friendly alternatives to rail and truck transport.

Facilitate the access to market: Through its wide origination network, Nibulon annually procures grains from up to 4,700 farmers. As a result, these farmers benefit from a reliable marketing channel and from access to Nibulon’s storage, conditioning and transportation infrastructure.

IFC’s Expected Role & Additionality:

IFC’s expected additionality includes: (i) Countercyclical long-term financing; (ii) Corporate Governance advice; and (iii) Demonstration effect.

Description of Main Environmental & Social Risks and Impacts of the Project:

Please refer to the Environmental and Social Review Summary (ESRS) linked to this project SII in the IFC’s project disclosure website.

For inquiries and comments about the project contact:

Company Nibulon

Point of Contact Olga Babanina

Title CFO

Telephone Number +38 (0512)76-62-52

Email OBabanina@nibulon.com.ua

Mailing Address 9B Fаleyevska Str., 54030 Мykolayiv, Ukraine

Website http://www.nibulon.com/

Local access of project documentation:

Nibulon will utilize its web page to publicize this Summary of Investment Information

For inquiries and comments about IFC:

General IFC Inquiries IFC Communications 2121 Pennsylvania Avenue, NW Washington DC 20433 Telephone: 202-473-3800 Fax: 202-974-4384

Nibulon, draft ESRS, 20170208